DeFi Yield Aggregators: How They Work and Why They Matter

Key Takeaways

- Automated Yield Farming: DeFi yield aggregators scan multiple protocols, reallocate funds, and reinvest rewards to maximize returns.

- Smart Contract Efficiency: These platforms use automation and AI-driven strategies to optimize earnings, reduce gas fees, and minimize manual effort.

- Risk Considerations: While aggregators help manage risks like impermanent loss and yield volatility, they do not eliminate them entirely.

- Passive Income & Diversification: Investors benefit from a hands-off approach, but periodic monitoring is essential for risk management.

Understanding DeFi Yield Aggregators

Decentralized finance (DeFi) has grown from an experimental niche to a vast ecosystem encompassing lending, trading, and yield farming.

With total value locked (TVL) in DeFi fluctuating between $40 billion and $200 billion in recent years, maximizing returns has become both lucrative and competitive.

Manually tracking the best yield farming opportunities across protocols is inefficient and time-consuming. This is where DeFi yield aggregators come in—automating yield strategies to optimize profits while minimizing user effort.

How DeFi Yield Aggregators Work

DeFi yield aggregators are platforms that consolidate yield opportunities from various DeFi protocols, including lending platforms (Aave, Compound), decentralized exchanges (Uniswap, Curve), and liquidity pools.

They function similarly to how Google Flights aggregates airline prices—helping users find the best returns without manual tracking.

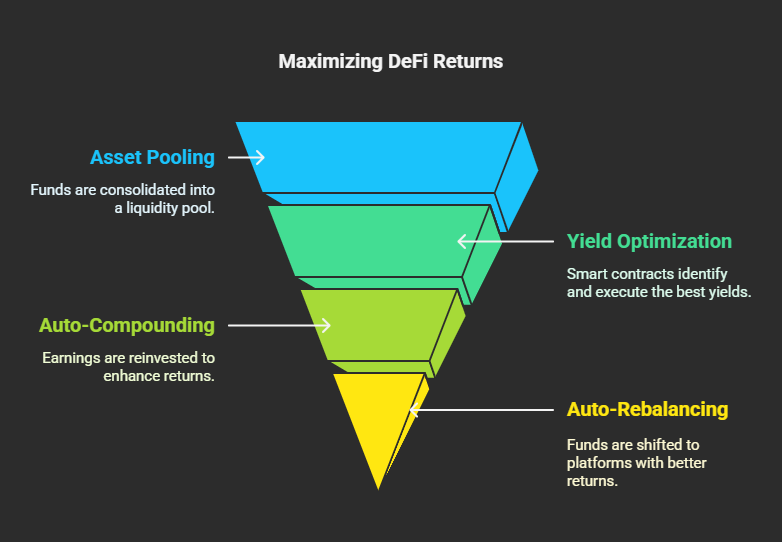

DeFi yield aggregators function as automated tools that help investors maximize their earnings from decentralized finance (DeFi) protocols. Here’s a more detailed breakdown of how they work:

1. Asset Pooling

- Users deposit assets such as Ethereum (ETH), USD Coin (USDC), or DAI into a DeFi yield aggregator.

- The aggregator consolidates these funds into a single liquidity pool, enabling more efficient deployment of capital across different yield-generating platforms.

Automated Yield Optimization:

- The aggregator employs smart contracts that scan multiple DeFi platforms (like Aave, Compound, and Curve) to identify the best available yields.

- These smart contracts execute predefined strategies that take into account factors such as annual percentage yield (APY) trends, transaction (gas) fees, and associated risks.

- The goal is to maximize returns while ensuring capital efficiency.

Auto-Compounding:

- When users earn yield (interest, staking rewards, or liquidity incentives), the aggregator automatically reinvests the earnings into the same or other high-yield strategies.

- This continuous reinvestment process increases the compounding effect, allowing investors to grow their returns over time without manual intervention.

Auto-Rebalancing:

- The aggregator constantly monitors DeFi platforms to determine where funds should be allocated for the best returns.

- If another platform offers a higher APY or better risk-adjusted returns, the smart contracts automatically shift funds to the new platform.

- This ensures that deposited assets are always earning optimal yields, maximizing profitability without requiring user action.

For Example: A user deposits USDC into a Yearn Vault. If Aave offers a 5.5% APY and Compound provides 5.2%, the vault moves funds to Aave. If Compound’s rate surpasses Aave later, the vault reallocates accordingly.

Benefits of DeFi Aggregators

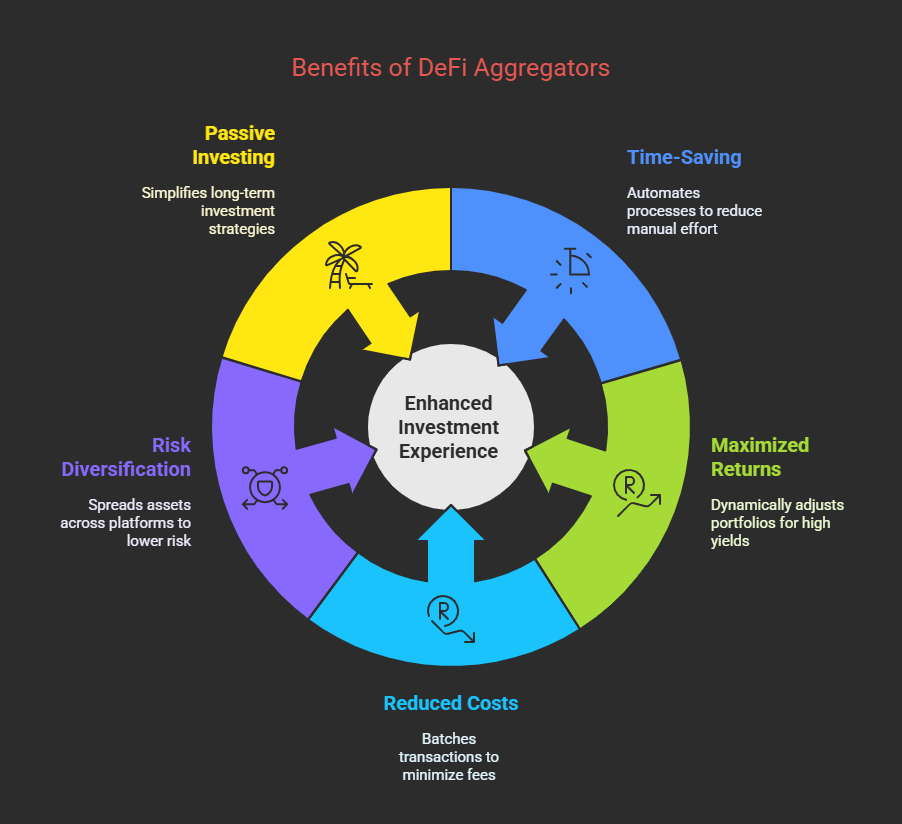

Time-Saving & Effortless Investing

Tracking multiple platforms for optimal yields is cumbersome. Aggregators automate this process, eliminating the need for manual intervention.

Maximized Returns Through Auto-Rebalancing

Yield rates fluctuate frequently. Aggregators adjust portfolios dynamically to ensure continuous high returns.

Reduced Gas Costs & Transaction Fees

Manual transactions on Ethereum can be costly. Aggregators batch transactions, minimizing gas fees and maximizing net gains.

Risk Diversification

Investing in a single protocol exposes funds to high risks. Aggregators distribute assets across multiple platforms, reducing exposure to smart contract failures.

Passive Investing Made Easy

For long-term investors, aggregators offer a “set-and-forget” strategy that simplifies DeFi yield farming.

DeFi Yield Aggregators vs Centralized Crypto Exchanges

| Feature | DeFi Yield Aggregators | Centralized Exchanges (CEX) |

|---|---|---|

| Fund Control | User retains full custody | Exchange controls funds |

| KYC Requirement | No KYC required | KYC mandatory |

| Risk Factors | Smart contract vulnerabilities | Exchange hacks, regulations |

| Yield Optimization | Automated, decentralized | Manual, centralized |

Also Read - Guide on Defi Regulations

Risks Associated with DeFi Yield Aggregators

Impermanent Loss

Yield aggregators frequently interact with Automated Market Makers (AMMs) such as Uniswap, Curve, and Balancer, where liquidity providers deposit assets into liquidity pools.

Impermanent loss occurs when the price of deposited assets changes compared to the price at the time of deposit. This results in an imbalance when liquidity providers withdraw funds.

Example:

Suppose a user deposits ETH and USDC into a Uniswap liquidity pool. If ETH’s price significantly increases, arbitrage traders rebalance the pool by adding more USDC and removing ETH.

When the user withdraws, they receive fewer ETH tokens than originally deposited, leading to an impermanent loss compared to simply holding ETH. While yield aggregators optimize returns, they cannot eliminate impermanent loss, as it is an inherent risk of liquidity pools.

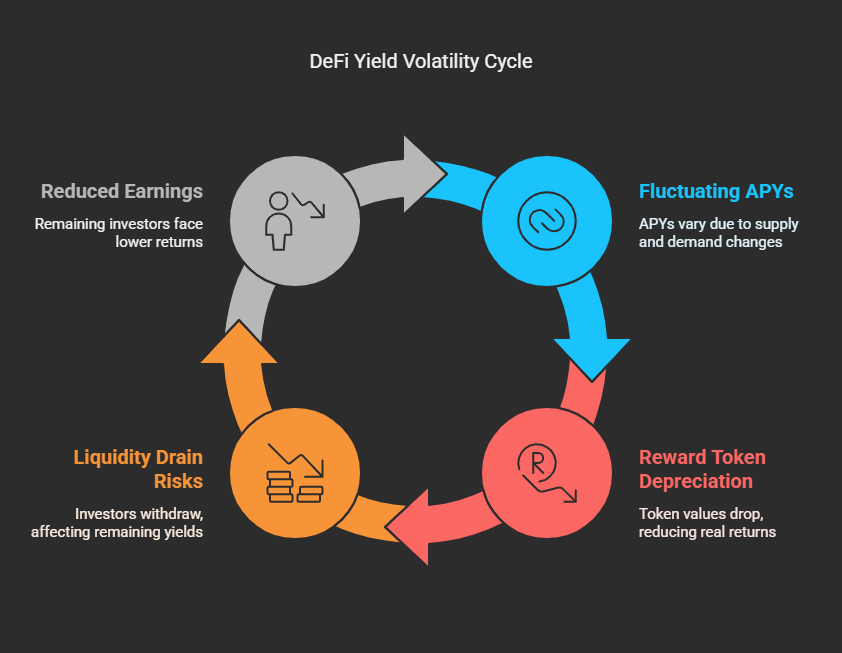

Yield Volatility

Unlike traditional finance, where interest rates are relatively stable, DeFi yields fluctuate due to various market dynamics, including liquidity changes, reward structures, and governance token incentives.

Fluctuating APYs

The Annual Percentage Yields (APYs) in DeFi pools can vary drastically based on supply and demand. A high-yield pool today may offer significantly lower returns tomorrow.

Reward Token Depreciation

Many yield farming platforms distribute rewards in their native tokens. If the price of these tokens drops significantly, the real return diminishes.

Liquidity Drain Risks

When a yield farm attracts a large number of investors, returns often decrease. Additionally, if a high-yield pool experiences a liquidity exodus (where users withdraw en masse), remaining investors may suffer reduced earnings or difficulty withdrawing funds.

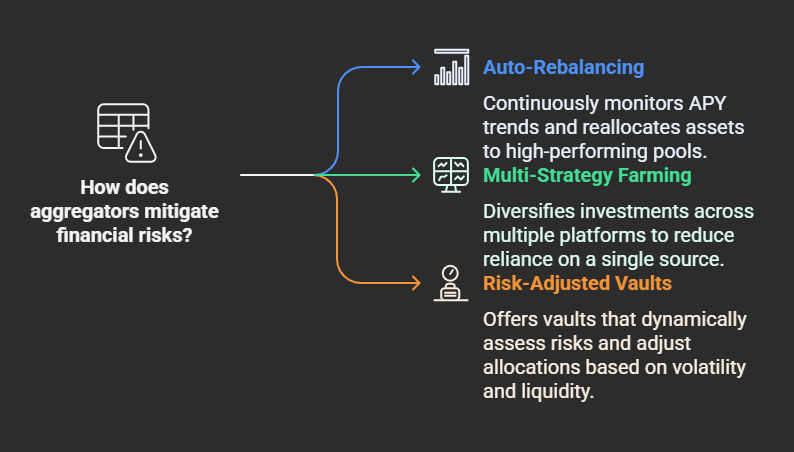

How Aggregators Mitigate These Risks

- Auto-Rebalancing: Aggregators continuously monitor APY trends and reallocate assets to high-performing pools.

- Multi-Strategy Farming: By diversifying investments across multiple platforms, aggregators reduce over-reliance on a single yield source.

- Risk-Adjusted Vaults: Some aggregators offer vaults that assess risks dynamically, adjusting allocations based on factors like volatility and liquidity depth.

However, no strategy guarantees stable returns, and investors must actively monitor their portfolio performance despite automation.

Final Take – Defi Aggregator

DeFi yield aggregators simplify yield farming by automating fund allocation, reinvestment, and risk management. While they enhance efficiency and returns, users must remain aware of potential risks like impermanent loss and yield volatility. By choosing reliable aggregators and aligning strategies with risk tolerance, investors can maximize DeFi earnings with minimal effort.

Popular DeFi Yield Aggregators in 2025

- Yearn.finance – Smart vaults with auto-rebalancing strategies.

- Convex Finance – Specializes in boosting Curve yields.

- AutoFarm – Multi-chain aggregator with optimized farming strategies.

- Beefy Finance – Offers cross-chain auto-compounding vaults.

As DeFi continues to evolve, yield aggregators will remain essential tools for maximizing passive income and optimizing investment strategies.

FAQs on DeFi Yield Aggregators

1. What is a DeFi yield aggregator?

A DeFi yield aggregator is a platform that automatically finds and allocates crypto assets to the most profitable yield farming opportunities. It optimizes returns by auto-compounding rewards, rebalancing funds, and reducing gas fees.

2. How do DeFi yield aggregators work?

These platforms pool user funds, deploy them across multiple DeFi protocols, and use smart contracts to optimize yield farming strategies. They track APYs, rebalance funds, and reinvest rewards to maximize earnings.

3. What are the benefits of using a yield aggregator?

- Automation: Eliminates the need for manual tracking and investment decisions.

- Higher Returns: Auto-rebalancing ensures funds are placed in the highest-yielding opportunities.

- Lower Fees: Gas fees are minimized by batching transactions.

- Risk Diversification: Funds are spread across multiple protocols, reducing exposure to single-platform failures.

4. Are DeFi yield aggregators safe?

While aggregators improve efficiency, they are not completely risk-free. Risks include:

- Smart contract vulnerabilities (potential hacks or bugs).

- Impermanent loss in liquidity pools.

- Yield volatility due to fluctuating APYs.

- Platform security risks (rug pulls or governance issues).

Investors should choose well-audited aggregators and monitor their funds periodically.

5. Can I lose money using a yield aggregator?

Yes, risks like impermanent loss, smart contract failures, and sudden yield drops can lead to losses. However, diversified and risk-adjusted strategies help minimize these risks.

6. How do DeFi yield aggregators compare to centralized exchanges (CEXs)?

Unlike CEXs, yield aggregators offer decentralized, non-custodial solutions where users retain control of their funds. However, they require a basic understanding of DeFi mechanics, whereas CEXs provide a more beginner-friendly experience.

7. How do yield aggregators earn revenue?

Most aggregators charge a performance fee (e.g., a percentage of profits) and a withdrawal fee to sustain platform operations and governance.

8. How often should I monitor my investment in a yield aggregator?

While yield aggregators automate most tasks, periodic monitoring is advisable to check for APY fluctuations, strategy changes, and smart contract updates.

9. Can beginners use DeFi yield aggregators?

Yes, but beginners should first understand yield farming, smart contracts, and DeFi risks before committing funds. Some platforms offer beginner-friendly interfaces, but a basic grasp of DeFi mechanics is beneficial.